Life Insurance in and around Butler

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Would you like to create a personalized life quote?

- East Butler

- Mars

- Meridian

- Connoquenessing

- Cranberry Twp

- City of Butler

- Evans City

- Saxonburg

- Prospect

- Slippery Rock

- Seven Fields

- Gibsonia

- Wexford

- Zelienople

- Allegheny County

- Westmoreland County

- Mercer County

- Lawrence County

- Armstrong County

- Grove City

- Portersville

- Harmony

- Chicora

- Harrisville

It's Never Too Soon For Life Insurance

When it comes to dependable life insurance, you have plenty of choices. Evaluating riders, providers, coverage options… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Gwen Sciullo is a person who is dedicated to helping you generate a plan for your specific situation. You’ll have a hassle-free experience to get cost-effective coverage for all your life insurance needs.

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Life Insurance Options To Fit Your Needs

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Gwen Sciullo is waiting to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

Contact State Farm Agent Gwen Sciullo today to check out how a State Farm policy can protect your loved ones here in Butler, PA.

Have More Questions About Life Insurance?

Call Gwen at (724) 285-3259 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

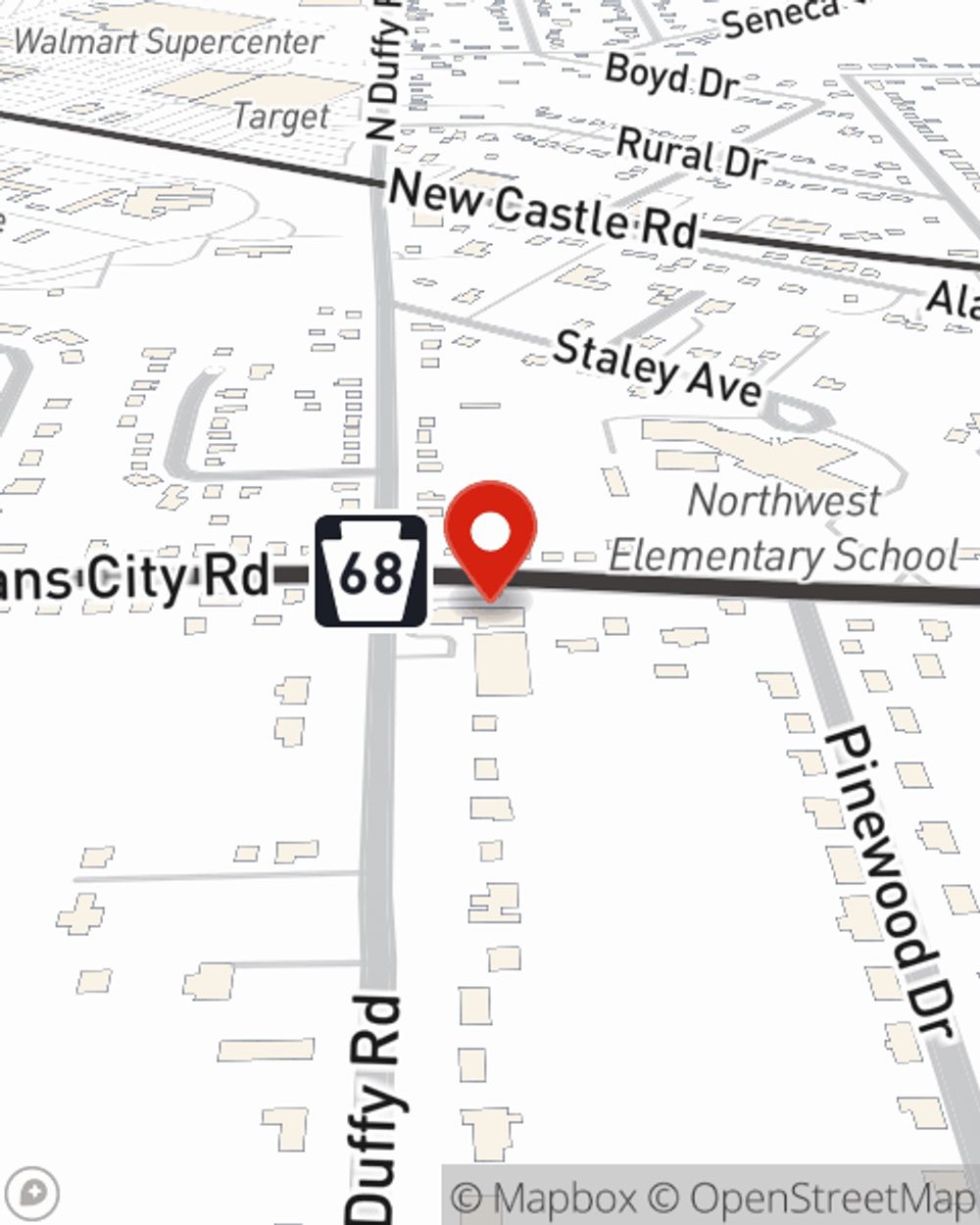

Gwen Sciullo

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.